Bitcoins’ market dominance makes it an excellent candidate for DeFi dapps

Amongst the hype surrounding the Bitcoin Halving. It is important to take the time to look at the possible effect on the Ethereum dapp ecosystem.

At first impression, it might appear there’s little crossover between Bitcoin and Ethereum. Sure, both are proof-of-work blockchains, and BTC and ETH are the two most significant cryptocurrencies by some distance.

But given Bitcoin is now considered to be a long term ‘store of value’, while Ethereum is positioned as ‘programmable money’, the way they’re being used is notably very different.

And that’s the way Bitcoin Maximalists (as maybe some Ethereum evangelists) would like to keep it.

Bitcoin Halving

So, as Bitcoin experiences its third halving event – reducing block rewards, and maybe driving a new price uptick – it would seem that aside from price dynamics, there’s not going to be much impact on the ever-expanding Ethereum dapp ecosystem.

When it comes to decentralized finance (DeFi) dapps, however, this assumption could be looking increasingly misplaced.

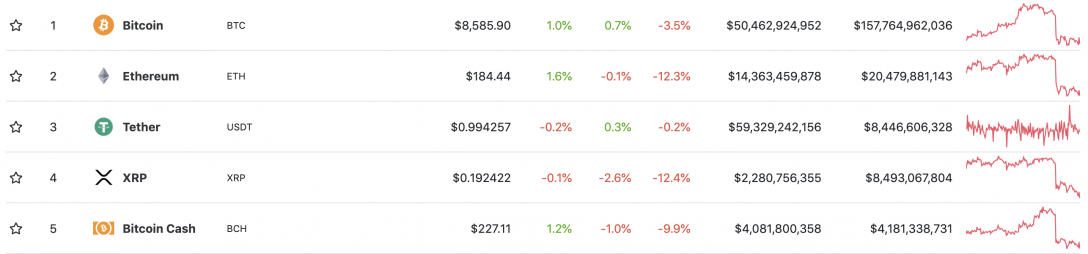

The reason is due to a surprising synergy between the two blockchain’s cryptocurrencies. With over $160 billion in market capitalization (at time of writing), BTC is by far the dominant cryptocurrency in terms of overall value, and #2 in terms of daily trading volume behind the stablecoin Tether.

This makes it an excellent candidate for use in DeFi dapps, which provide the cutting edge of the ‘Ethereum as programmable money’ experiment.

The result is increasingly clever ways of combining these two seemingly incompatible cryptocurrencies.

One of the first examples was Wrapped Bitcoin (WBTC), which mints an Ethereum-based WBTC token every time a BTC token is locked into its smart contract. Of course, the process can be reversed, with a BTC token unlocked back from the smart contract every time a WBTC token is burnt through it.

Each WBTC token has the same fiat value as a BTC token and can be used in various DeFi dapps, including, most recently, MakerDAO, in which WBTC is now one of the assets that can be used as collateral to mint the DAI stablecoin.

Growing ecosystem

Another example of bringing BTC to DeFi is tokenized BTC, which is known as imBTC.

Created by the Tokenlon exchange, it works in much the same way as WBTC, enabling users to take their BTC, convert it into imBTC (and back again), and use it in various DeFi dapps for trading or as collateral for loans.

In this way, both of these two projects hope to bring some of the billions of dollars of value stored in the Bitcoin blockchain into Ethereum’s growing ecosystem for programmable money.

That said, neither token has been massively successful. To-date, WBTC has attracted less than $15 million of value, while imBTC has been involved in a couple of exploits due to its use of the new ERC777 token standard, which has caused issues for some insecure DeFi smart contracts.

Synthetix

In that context, a much cleaner and less complex way of integrating BTC into Ethereum DeFi dapps has been demonstrated by Synthetix, which has created its sBTC (or synthetic BTC) token as part of its synthetic asset trading platform.

The sBTC token isn’t backed directly by locking BTC tokens into a smart contract. More generally, however, it is backed by a pool of cryptocurrencies so there’s no counterparty risk and it does enable users to effectively hold and/or trade based on BTC’s fiat value on Ethereum, without the hassle of actually owning any BTC.

A different non-custodial approach is offered by the just-launched Atomic Loans dapp, which runs on Ethereum but enables users to lock their BTC into a smart contract as collateral and then generate stablecoin loans.

And, no doubt, many more companies are working on new and novel ways of bringing together these two very different, yet ultimately synergistic, digital assets.

It remains to be seen how the Bitcoin Halving will truly affect the Ethereum DeFi dapp ecosystem and its key players. It’s going to be an interesting couple of weeks and months.

More similar articles you can find here.

Comments