Chinese police have recently busted a major cryptocurrency scam suspected of using cryptocurrency OTC transactions for money laundering.

The scammers created a forged Huobi website to defraud, and then carry out OTC money laundering by a group to transfer the money obtained from the fraud to an overseas account, according to local police in Guangzhou, a city of Guangdong province in south China.

One of the victims was attracted by the overseas investment project of speculation of bitcoin, then the victim successively remitted 3.1 million Chinese yuan to different bank accounts provided by the platform, finally, his accounts suffered a huge loss.

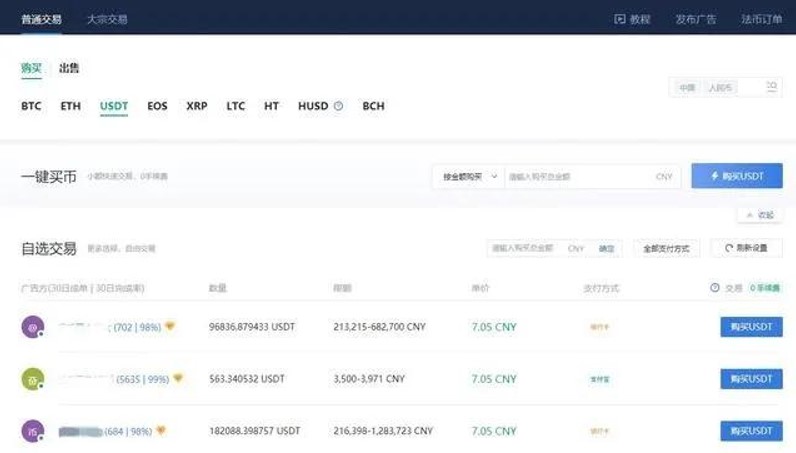

The forged Huobi OTC website provided by the police

After the suspects were arrested, they confessed the money laundering process: when the account received the money transferred from the fraudulent criminals, they would transfer money to WeChat or Alipay to purchase the Internet financial products provided by the platform. These funds are then used to buy and sell cryptocurrencies in private, and a certain percentage of commissions are drawn from them. According to the suspect, police found that they had got more than 300000 Chinese yuan in less than half a year by money laundering through cryptocurrency.

Since the first quarter of this year, China’s central bank has made unprecedented efforts in anti-money laundering, as the fines related to anti-money laundering have almost equal to last year. Many enterprises engaged in OTC, transaction, loan in the crypto space have been investigated more frequently recently by the local financial bureau and the police.

Major crypto exchanges in China have close cooperation with the financial bureau, police, and other regulatory agencies. For example, Huobi launched the development of the “astrology system” in July 2018, and successfully launched the internal test in September 2019. It was officially launched on April 13 this year, aiming at suspicious or malicious assets, darknet, mixed currency services, and other risky assets, to achieve the goal of active tracking, automatic disposal of the inflow platform, and horizontal attack of association analysis.

On March 22, China’s central bank issued 315 warning in the WeChat, saying that through the analysis of withdrawal data of the cryptocurrency trading platform, it found that bitcoin has been transferred in several times in small amount and cleared out in large amount, which conforms to the basic characteristics of money laundering. Because of its anonymity and global characteristics, the cryptocurrency like bitcoin may become the accomplice of criminals.

Comments